Digitap ($TAP) vs $944 BNB: Which is the Best Crypto for Banking & Privacy in January 2026?

As the global financial market reaches a fever pitch in January 2026, a fundamental collision is happening. The established projects of the previous decade are competing for dominance with new, utility-first protocols.

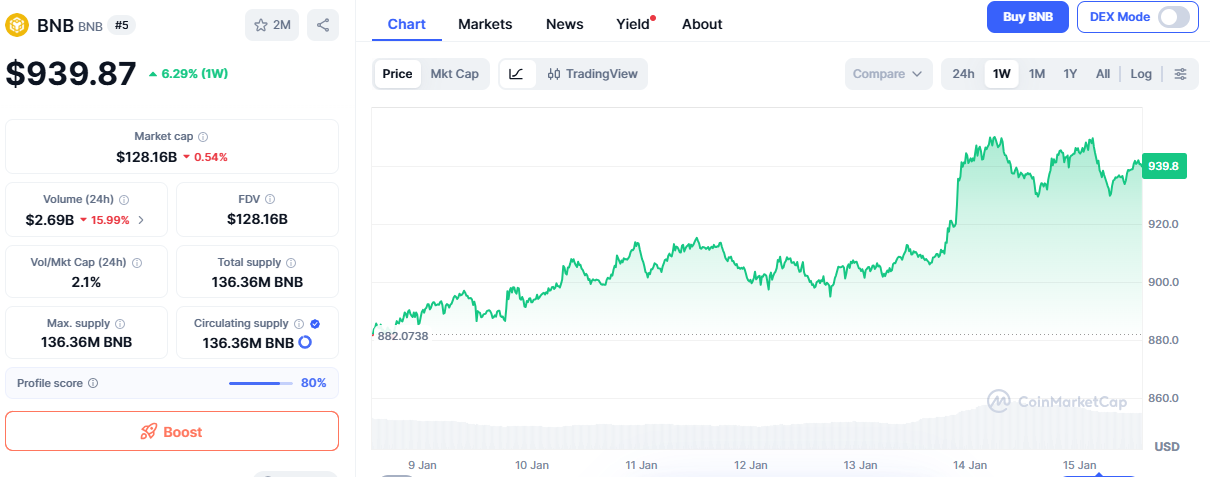

Binance Coin (BNB) has gained momentum since the beginning of the year to hit $944 recently. This growth has boosted the token’s position as the backbone of the world’s biggest exchange. Despite the bullish BNB momentum, smart money is flowing toward Digitap ($TAP), an omni-bank ecosystem.

Digitap has successfully bridged the gap between decentralized finance and traditional retail banking. In this cycle, investors are no longer moving toward assets with the highest price. They prefer the projects that offer the best banking utility and personal privacy in a world defined by increased institutional oversight.

As users take positions for the next cycle, Digitap is emerging as the best crypto to buy due to its integration with Visa and a no-KYC feature. Furthermore, $TAP is built to operate in the real-world economy.

Why Digitap’s Omni-Bank Ecosystem Outshines BNB’s Utility

While BNB works as a fuel for exchange transactions and gas on the BSC network, Digitap is building an omni-bank ecosystem. This ecosystem blends spending tools, crypto storage, fiat settlement, and card-based payments. Moreover, its integration of tools and components helps resolve the challenge of fragmentation, which has affected the crypto industry for many years.

Users are disgruntled by the tedious process involved in using multiple apps and platforms to execute simple transactions. On that note, Digitap is built to solve this problem by centralizing payments, balances, and settlements on one platform. Therefore, crypto can be held, converted, and spent without needing to engage with third-party platforms.

Digitap is not thriving on future promises; it has already deployed live iOS and Android applications. These applications support the smooth movement of value between traditional banks and digital wealth. Thus, Digitap provides a level of banking utility that an exchange token like BNB cannot match.

The project’s integration with Visa also accelerates $TAP’s adoption. With many unbanked people around the world, Digitap appeals to this group since it does not have onboarding restrictions stipulated by traditional banks. Therefore, investors consider it the best crypto to buy for 2026.

BNB’s Centralization Risks are Pushing Capital into Digitap

BNB’s growth in recent weeks proves the resilience of the Binance ecosystem and Smart Chain (BSC). However, its surge to $944 does not appeal to investors looking for multiplier gains because they consider it a mature, high-cap asset. Most investors, especially small traders, do not see an opportunity for life-changing gains in BNB.

Additionally, BNB is extensively connected to a centralized entity that has encountered increased regulatory scrutiny. In 2026, BNB holders are no longer worried about technical performance. They are disgruntled by the growing risks of centralized chokepoints that restrict their free operation.

Binance is continuously aligning with global regulatory frameworks to retain its market position. With this alignment, the inherent privacy that previously made crypto appealing is being sacrificed for institutional compliance.

For investors seeking real financial sovereignty, BNB is not an ideal opportunity. The project has changed from a revolutionary tool into a digital version of a traditional brokerage. Digitap has become a favorite among users because it offers no-KYC features, making it a good crypto to buy.

No-KYC Feature Gives Digitap an Edge Over BNB’s Strict Oversight

Privacy seems to be the most valuable commodity in the current crypto market bull cycle. The market favors privacy, especially with exchanges and other established institutions needing proof of identity for users to transact on their platforms. In this environment, the difference between BNB and Digitap is massive.

BNB’s utility is locked by the increasingly strict Know Your Customer (KYC) requirements of the Binance exchange. This makes every transaction part of a permanent, identifiable trail readily accessible to regulators.

On the contrary, Digitap prioritizes a privacy-by-design model. Its omni-bank ecosystem offers a no-KYC virtual Visa card, enabling users to spend their crypto globally without the invasive identity checks stipulated by centralized exchanges.

The focus on user autonomy makes $TAP the best crypto to buy for investors who consider financial privacy a prerequisite for wealth preservation this year.

Digitap’s Visa-Powered Utility Beats BNB’s On-Chain Limits

A notable difference between these assets is the way they interact with the real world. BNB’s main utility is on-chain, meaning it requires users to navigate complex off-ramps or use branded cards, which are often restricted by region or centralized spending limits.

Digitap has solved this challenge by collaborating with Visa to help boost $TAP’s access and accelerate its rate of adoption in the physical world. Visa’s global payment infrastructure is linked to over 80 million merchant locations.

Since Digitap’s omni-bank handles conversions at the point of sale, users can hold $TAP and other digital assets and spend them like cash. In that context, Digitap bridges the gap between the global financial industry and digital assets by incorporating crypto spending into the Visa network.

The bridge to the multi−trillion−dollar global retail market gives $TAP a transactional speed that far outpaces the trading-centric volume of BNB. This explains why $TAP is considered among the best altcoins to buy for 2026.

$TAP’s 69.5% Discounted Crypto Presale Offers Bigger ROI Than BNB

Based on an investment perspective, the comparison between BNB at $944 and $TAP in its presale is a study in asymmetric opportunity. BNB’s market cap needs hundreds of billions of dollars in new capital to double its value.

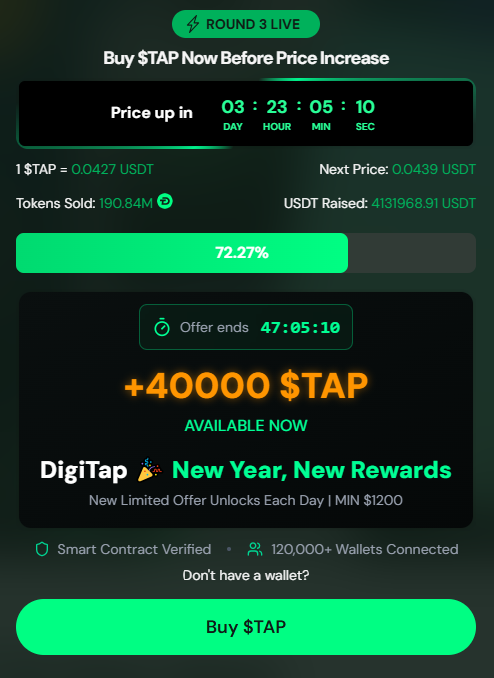

On the other hand, Digitap’s crypto presale is a great entry point into the industry. Currently, the $TAP token is available at $0.0427, a 69.5% discount from its launch price of $0.14. This project has a fixed pricing model designed to increase with every round.

Digitap features a hyper-deflationary model where 50% of its banking profits are used for buybacks and burns. This strategy ensures that as the project attracts more users, $TAP’s supply reduces, creating a scarcity event that helps it achieve multiplier gains once it hits the mainstream markets.

Over 120,000 wallets have already been connected to the presale dashboard, and over 190 million tokens have been sold. Furthermore, the project has raised over $4.1 million.

Future of Finance: Digitap’s Privacy-Led Omni-Bank Outperforms BNB

The choice between BNB at $944 and $TAP in its crypto presale stage is a decision between the past and future of finance. As the 2026 bull cycle intensifies, BNB remains a powerful asset, but its profit margin is restricted by centralization and a huge market cap.

On the other hand, Digitap’s omni-bank ecosystem is live and operational. The project offers increased privacy, real-world utility, and massive growth potential, things that current investors demand.

For investors looking for the best crypto to buy this January for privacy and banking, Digitap is the perfect match. It has the infrastructure to participate in the coming bull cycle and redefine how wealth is spent and managed in the digital era.

Discover how Digitap is unifying cash and crypto by checking out their project here:

Presale: https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

Read More

All NewsBelarus has taken a another step in cryptocurrency adoption as President..

Discover how the best crypto to buy today is being debated..

Federal authorities in the United States have found Brian Garry Sewell..

BlockchainFX is the world’s first crypto exchange connecting traditional finance with blockchain. Join the $BFX presale today and secure your chance for 100x gains!

Join Now