Strategy Adds 4,225 Bitcoin, Now Holds Over $73 Billion Worth of BTC

Strategy revealed it has acquired 4,225 more Bitcoins for about $472.5 million. This latest acquisition was done between July 7 and July 13, according to its new filing with the U.S. Securities and Exchange Commission (SEC).

This latest move brings the company’s total stash to 601,550 BTC, worth over $73 billion at current prices. This move reaffirms Strategy’s long-term commitment to Bitcoin as its core asset.

Strategy Fuels Bitcoin Buying Spree With Stock Sales

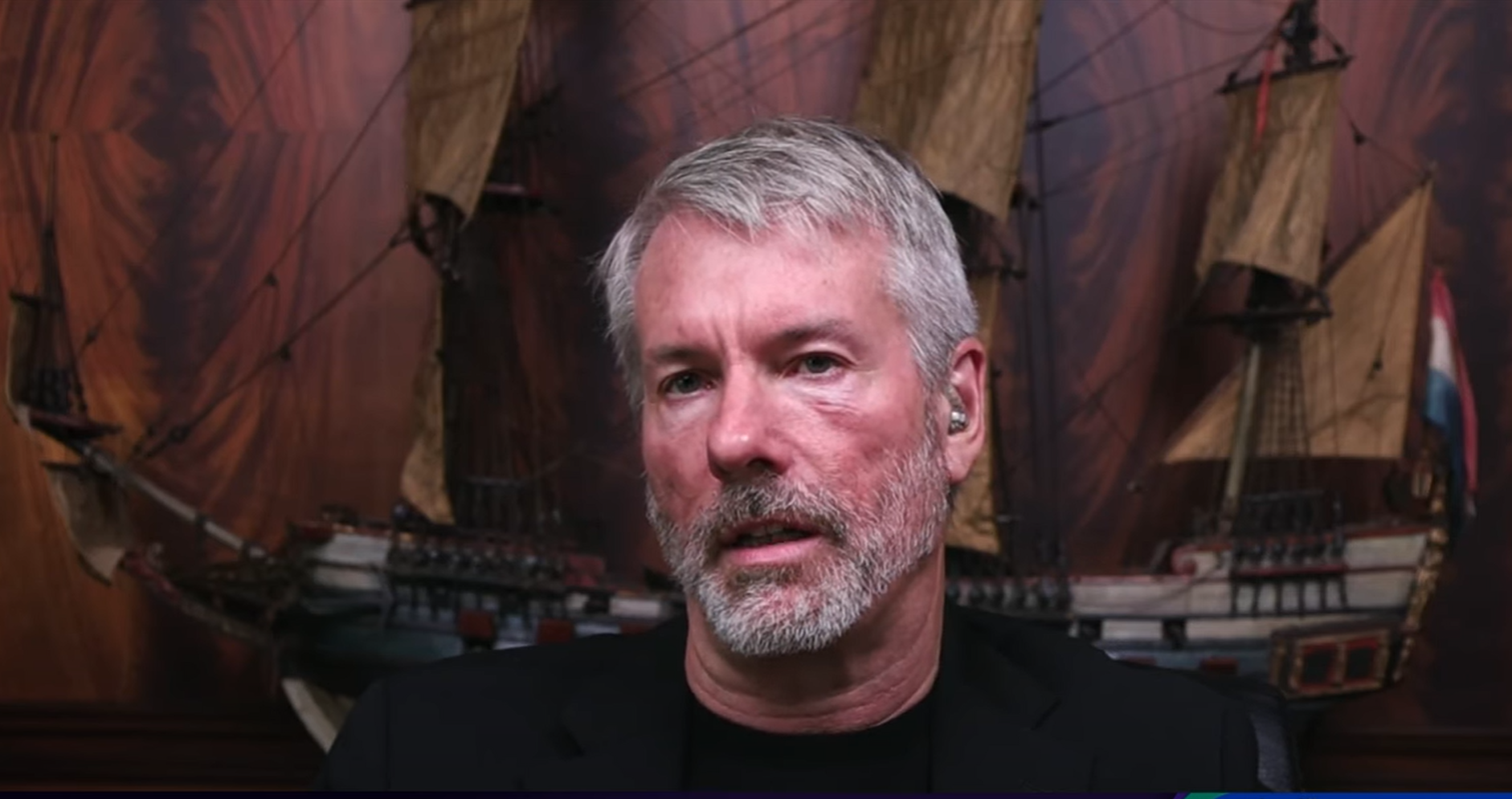

As announced, Strategy bought the recent batch of Bitcoin at an average price of $111,827 per coin. Chairman Michael Saylor said the company has spent about $42.9 billion, including fees, on its total holdings. This gives Strategy an average purchase price of $71,268 per Bitcoin.

With the latest price rally, the company is sitting on about $30 billion in unrealized gains. That means Strategy now controls more than 2.8% of Bitcoin’s maximum 21 million supply. This firmly positions it as the largest corporate holder of the asset.

Furthermore, the firm said it sold several types of shares to fund its latest Bitcoin purchase. This includes common stock (MSTR) and three types of preferred shares: STRK, STRF, and STRD. Altogether, the Nasdaq-listed firm raised nearly half a billion dollars through these sales.

These share sales are part of Strategy’s bold “42/42” capital plan. The company aims to raise $84 billion through equity and convertible notes to buy more Bitcoin through 2027. This target was doubled from the original “21/21” plan after Strategy used up its earlier equity allocation.

Strategic Pauses and Market Moves

Interestingly, the latest crypto purchase came after a brief pause from June 30 to July 6, which matched the timing of Strategy’s second-quarter results. During that period, the firm reported an unrealized gain of $14.05 billion on its Bitcoin holdings.

A similar pause occurred in April, around the time of its Q1 report, when the company’s unrealized losses stood at $5.91 billion. Before the current purchase, the U.S.-based firm had acquired 4,980 BTC for $531.9 million between June 23 and June 29.

Strategy Leads a Growing Group of Bitcoin Holders

According to Bitcoin Treasuries, 141 public companies now hold the flagship crypto, with Strategy leading the list. Nevertheless, the top holders also include MARA, Tether-backed Twenty One, Riot Platforms, and Metaplanet.

Despite concerns from some investors, Strategy’s premium to net asset value (NAV) continues to grow, now valued at around $118.8 billion. Analysts point to its low debt levels and no payments due until 2028 as signs of financial stability.

Strategy’s Bitcoin gains have boosted its MSTR stock. On Friday, the stock closed at $434.58, up by 3%. It is up 2.1% in pre-market trading on Monday. So far in 2025, MSTR has gained nearly 45%, outpacing Bitcoin’s 30.2% rise.

Read More

All NewsDecember 18, 2025

December 18, 2025

United States regulators have taken decisive action against a former Bitcoin..

Coinbase recently appointed former British finance minister George Osborne to lead..

A billion-dollar crypto yield shift is reshaping best altcoin picks as..

BlockchainFX is the world’s first crypto exchange connecting traditional finance with blockchain. Join the $BFX presale today and secure your chance for 100x gains!

Join Now