Jefferies Drops Bitcoin Over Quantum Computing Bitcoin Fears

Quantum computing Bitcoin concerns have pushed a major shift in Jefferies’ flagship model portfolio. This happened as strategist Christopher Wood removed its entire Bitcoin exposure and redirected funds toward gold assets. He cited long-term security risks tied to emerging technology.

Jefferies Removes Bitcoin From Model Portfolio

Christopher Wood, global head of equity strategy at Jefferies, has taken B.itcoin out of the firm’s well-known “Greed & fear” portfolio. The move ended a 10% allocation that had been in place since the pandemic period, when Bitcoin was viewed as a digital alternative to gold.

The decision was not based on short-term price expectations. Wood said Bitcoin prices may not face immediate pressure. Instead, he pointed to deeper risks linked to quantum computing Bitcoin security.

In his view, the long-term store-of-value case for bitcoin is weakening, especially for pension and institutional investors who focus on decades, not cycles.

The funds were split evenly into physical gold bullion and gold-mining stocks. Wood described gold as better suited for portfolios that need lasting protection against future technology threats.

He said the original logic behind Bitcoin, including its fixed supply and predictable issuance, no longer stands on firm ground when encryption risks are considered.

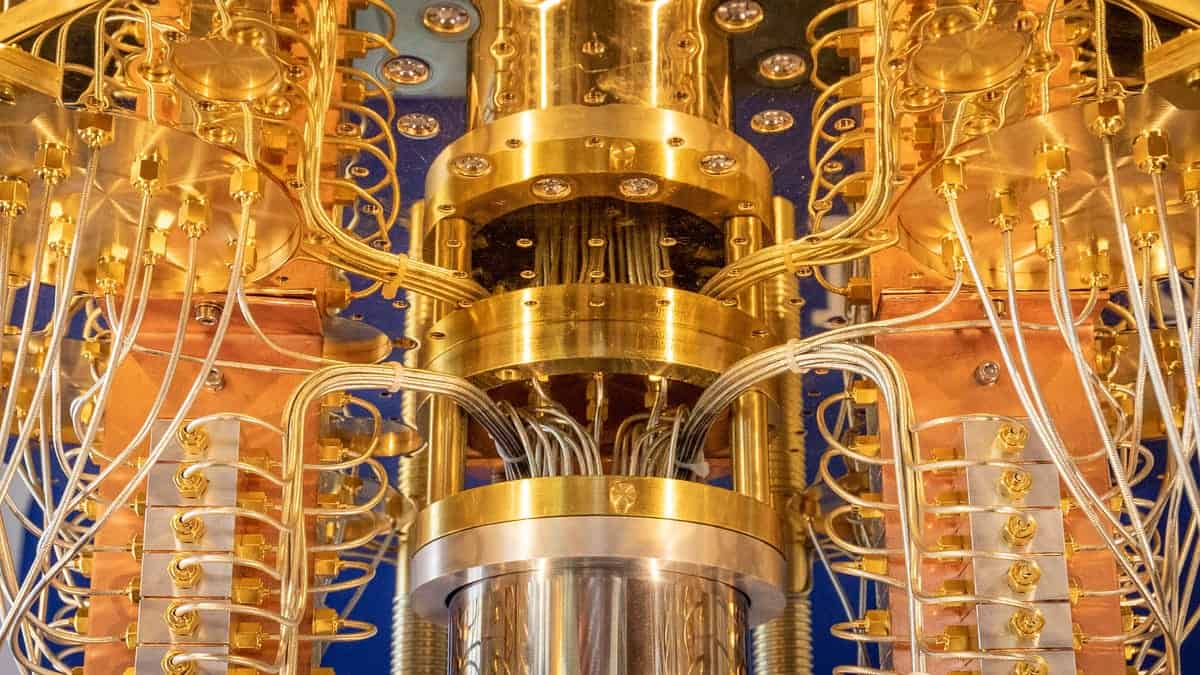

Research Highlights Scale Of Quantum Computing Bitcoin Threat

Wood cited a May 2025 study from Chaincode Labs that examined how quantum machines could impact Bitcoin wallets. Researchers estimated that between 4 million and 10 million Bitcoin could be exposed if quantum tools become powerful enough to extract private keys.

The study noted that reused addresses, often held by exchanges and institutions, face the highest risk. Early wallets from Bitcoin’s first years could also be vulnerable. Coinbase research echoed these findings, warning that as much as one-third of the supply could be at risk under advanced quantum attacks.

Microsoft’s unveiling of its Majorana 1 quantum chip earlier this year has added urgency to the debate. Industry observers say it could shorten the timeline to a point where existing encryption methods fail.

Industry And Governments Prepare For Quantum Risks

Efforts to address quantum computing Bitcoin risks are growing. Crypto security startup Project Eleven recently raised $20 million to build defenses against future attacks. Ethereum co-founder Vitalik Buterin has also outlined strict requirements for any network that aims to be quantum-safe over long periods.

Even governments are reacting. El Salvador reorganized its Bitcoin holdings last year, spreading them across multiple addresses to reduce exposure. As quantum technology advances, the conversation around crypto security is shifting from theory to preparation.

Read More

All NewsDiscover why the BNB Coin price is weakening, the Ethereum price..

Discover why the Canton price is rising, the Cardano price is..

Seize the shift as Hyperliquid drops and Zcash weakens while BlockDAG..

BlockchainFX is the world’s first crypto exchange connecting traditional finance with blockchain. Join the $BFX presale today and secure your chance for 100x gains!

Join Now