CoinShares posts Digital Asset Fund Flows Weekly Report; Here are interesting figures

Europe’s largest and longest-standing digital asset firm, CoinShares, recently shared its digital asset fund flow weekly report, which reveals that Short-Bitcoin Assets under management (AuM) surged to a new all-time high of $64 million at the beginning of last week.

JM Mognetti-founded CoinShares added that total AuM is currently at its lowest since February 2021, at $36 million, down by 59% from the November 2021 all-time high. However, the head of Research, CoinShares, James Butterfill, writes that despite the evident negative sentiment, year-to-date flows remain positive at $403 million.

[1/4]This week's Digital Asset Fund Flows Report is now available! Written by @jbutterfill, the headline for this week is: Record outflows from Short-Bitcoin suggest investors close to peak bearishness. Read on for the highlights -> pic.twitter.com/ovHMmhex2g

— CoinShares (@CoinSharesCo) June 20, 2022

As per the announcement, the aggregate figure masks a significant regional polarization of views, with outflows almost entirely coming from Canadian exchanges ($141 million), while inflows came from the US, Europe, and Brazil exchanges, totaling $79 million, $12 million, and $12 million, respectively.

CoinShares reports detailed inflows and outflows

As per the data by CoinShares, the world’s largest cryptocurrency, Bitcoin, which today reclaimed $20K, experienced inflows of $28 million last week, and it appears to be benefiting from low prices, with $46 million inflows so far this month. Short-Bitcoin AuM reached an all-time high of $64 million at the start of last week but experienced record outflows of $5.8 million, indicating that negative sentiment is nearing its peak.

Inflows to multi-asset investment products, which have been the most resilient in terms of inflows this year, totaled $9 million last week.

Coming to altcoins, the largest altcoin, Ethereum’s outflows continued last week, totaling $70 million after 11 weeks of outflows, bringing year-to-date outflows to $459 million. On the other hand, with inflows of $0.7 million last week and $109 million year-to-date, Solana appears to be benefiting from investor concerns about The Merge (ETH2), the data by the Paris-based CoinShares reveals.

Read More

All NewsJanuary 16, 2026

Despite BlockDAG being one of the most successful presales of 2025,..

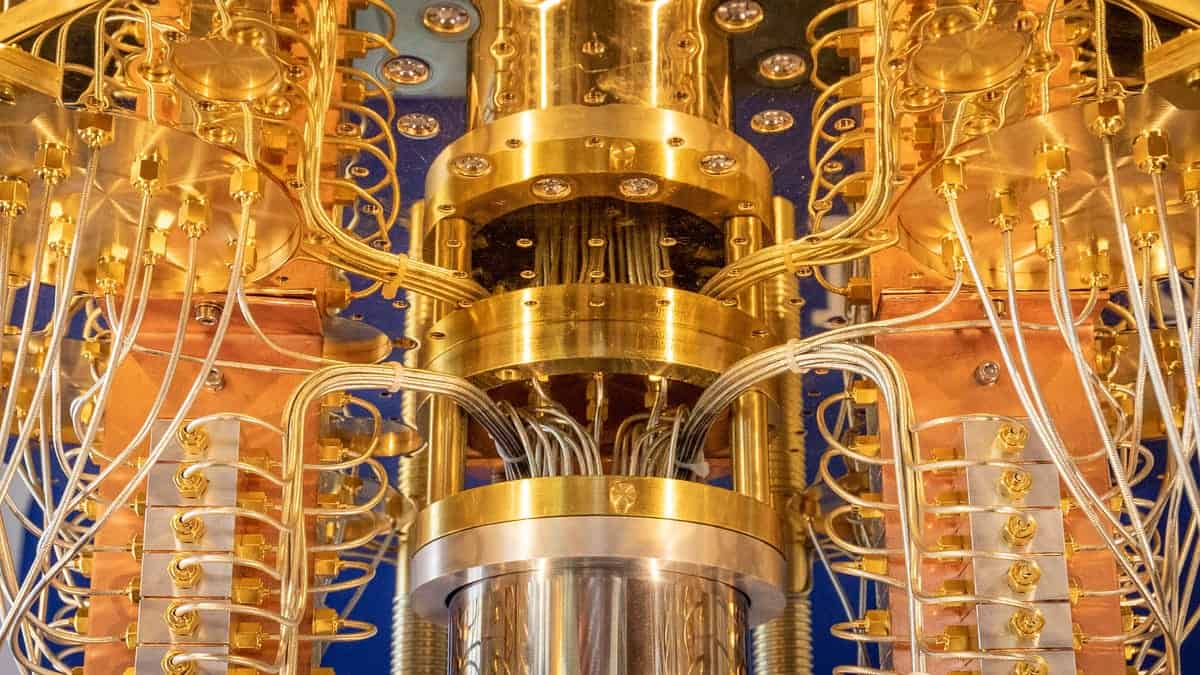

Quantum computing Bitcoin concerns have pushed a major shift in Jefferies’..

Digitap ($TAP) vs $944 BNB: Which is the Best Crypto for..

BlockchainFX is the world’s first crypto exchange connecting traditional finance with blockchain. Join the $BFX presale today and secure your chance for 100x gains!

Join Now